This blog was written by Dr Maria Ron Balsera, Research and Advocacy Coordinator, ActionAid.

COVID-19 has not only infected at least 91.6 million people and killed more than 1.96 million worldwide, it has also resulted in huge disruptions to our ways of life, including 1.6 billion children not being able to go to school in the first few months of the pandemic. COVID-19 effects on the economy are also alarming, with the deepest global recession in decades, a 5.2 percent contraction in global GDP in 2020, labour income declining nearly 11% or US$3.5 trillion in the first three quarters of 2020, which could lead to 150 million people being pushed into extreme poverty by 2021.

Governments are facing one of the most challenging times in history and many are rushing into short-term solutions that will have repercussions for many generations to come. The three ‘solutions’ below have been popular in the past, particularly among poorer countries:

- Debt

Borrowing money is a common strategy to pay for public services. According to the World Bank, “The total external debt of the 120 low- and middle-income countries rose by 5.4% in 2019 to $8.1 trillion, equivalent to 26% of their gross national income (GNI) […] This ratio has increased over the past decade in many low- and middle-income countries. Almost one third of low- and middle-income countries had external debt-to-GNI ratios above 60% at end-2019, compared with 23% in 2010, and in 9% of countries the ratio exceeded 100%, one-third more than the share of countries with a comparable ratio in 2010.” This increase in debt, compounded with shrinking GDPs and increasing spending as a result of the pandemic will exacerbate the debt crisis. ActionAid is among more than 100 organisations calling for countries’ debt to be cancelled to enable them to invest in health and social protection. Equally, debt service payments should not be over 12% of national budgets, to avoid excessive impacts on spending on public services. Yet, increasing debt levels, particularly with private banks, will result in greater debt repayments for generations.

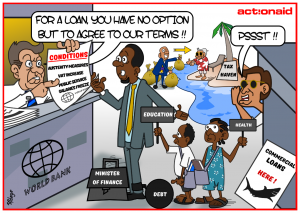

- Loans

The International Monetary Fund (IMF), World Bank (WB) and development banks have been playing a key role in lending money to countries to boost their economies. However, these loans come with structural conditions linked to austerity, e.g. freezing public sector wage bills, resulting in underfunded health, social protection and education budgets for decades. The economic reforms included in the Structural Adjustment Plans from the 70s (liberalisation, government spending reduction, etc.) had catastrophic effects in terms of development with far-reaching consequences, particularly for women, children and vulnerable groups. Although the IMF and WB claim to have moved away from the harmful advice of austerity, the new ‘fiscal consolidation’ mantra poses the same threat of thwarting sustainable development, increased inequalities and human rights violations. Yet, countries seem desperate to get the approval of these economic institutions and continue following their advice.

- VAT

Increasing indirect taxes such as sales taxes or Value Added Tax (VAT) has been favoured by many countries, particularly those without a sophisticated tax collection system. This is one of the most regressive forms of taxation, disproportionately affecting women and poor people. At a time of a reduction in sales, it would not even bring much revenue.

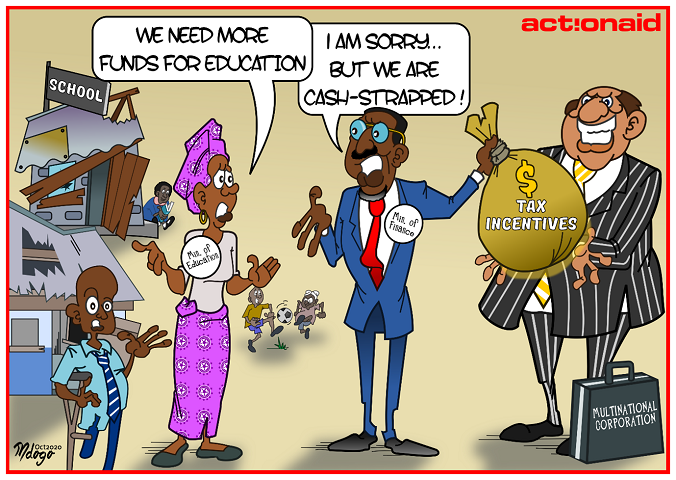

So, what to do? There is no magic money tree to cover the increased need to fund public services, especially health, education and social protection. Or is there? The magic tree in this case is the revenue currently foregone to tax incentives, tax avoidance and tax evasion that must be curbed, if not eliminated, in order to raise the necessary funds to provide quality gender responsive public services. With an estimated US$427bn lost to tax havens every year, the equivalent of the salary of a nurse lost to tax havens every second, and developing countries giving away around US$138 billion a year in tax incentives, this could be the so sought-after money tree that would enable countries to build back better in the COVID-19 recovery.

Progressive taxation reform is the best way to ensure a fair and sustainable recovery, it is about increasing revenue in a progressive manner, redistributing wealth, ensuring that the burden is carried equally, without corporate free-riders . Increasing domestic resource mobilisation through progressive taxation to provide gender responsive public services is the best way to improve governance, increase accountability and participation, and the only way to properly fund the Sustainable Development Goals. ActionAid found that most countries can increase their tax-to-GDP by 5% in the coming years and by 10% in the next decade through fair corporate tax, and properly taxing the income, capital, land and property of the wealthy. Therefore, countries should stop following the short-term strategy of increasing public debt and agreeing to the loan conditions provided by the IMF, WB and development banks and move swiftly to reform their tax system in a progressive way.

Progressive taxation reform is the best way to ensure a fair and sustainable recovery, it is about increasing revenue in a progressive manner, redistributing wealth, ensuring that the burden is carried equally, without corporate free-riders . Increasing domestic resource mobilisation through progressive taxation to provide gender responsive public services is the best way to improve governance, increase accountability and participation, and the only way to properly fund the Sustainable Development Goals. ActionAid found that most countries can increase their tax-to-GDP by 5% in the coming years and by 10% in the next decade through fair corporate tax, and properly taxing the income, capital, land and property of the wealthy. Therefore, countries should stop following the short-term strategy of increasing public debt and agreeing to the loan conditions provided by the IMF, WB and development banks and move swiftly to reform their tax system in a progressive way.